This might turn out to be the most important post I’ll ever write.1

The ideas that …

MicroStrategy MSTR 0.00%↑ is executing a speculative attack on fiat money by borrowing dollars and issuing shares to buy bitcoin.

The company is destined for S&P 500 inclusion, and that this is the trojan horse by which every “investor” (really: saver) starts to save in bitcoin, maybe without even knowing it.

Equity multiples deserve to be far, far lower than they are today if and when investors shift from a fiat mindset to a bitcoin mindset.

Equity markets are fundamentally broken by passive index investing strategies now making up over half of managed AUM in the US, which means that the marginal buyer and seller of equities is not sensitive to price.

Passive index investing only exists in the first place because people need a savings vehicle to preserve their purchasing power over time, as fiat money is not a good savings vehicle and does not fulfill money’s store-of-value function.

There are r/wallstreetbets and Occupy Wall Street societal undertones that have been brewing for 15 years and bubbling to the surface from time to time, would love to stick it to the man, have shown they’re capable of coordinating to do pretty incredible things during the GameStop saga, and now have a scarce, finite, open monetary system they can actually adopt instead of continuing to play along in the system they profess to dislike?

… are not my own original ideas, and have been bandied about by countless others on numerous forums.

But I have to yet see anyone synthesize these ideas and articulate the thesis that I am about to articulate — the precise mechanism by which bitcoin could absorb a significant amount of the monetary premium that I believe has been assigned to equities, substantially compress equity multiples, and see price moon way, way sooner than most anticipate.

It’s really all quite simple — there is an engine that is mining fiat to buy bitcoin, and that engine is on the cusp of tapping into a near limitless fuel source.

Step 1: Publicly Traded Equity Executes Speculative Attack on Fiat

Step 1 is already in motion and has been being executed by Michael Saylor and his company MicroStrategy since August 2020.

A speculative attack as it relates to currencies is when a speculator bets on a currency falling in value relative to another currency by borrowing it and selling it on the open market for the other, stronger currency.

The most famous example of a speculative attack is George Soros breaking the British pound in 1992, betting against it heavily and contributing to it having to de-peg from the Deutsche Mark and float freely. Soros’ Quantum Fund reportedly made over $1 billion in profit when he “broke the pound.”

Beginning in 2020, MicroStrategy began executing a speculative attack on fiat by borrowing dollars and using the proceeds to buy bitcoin.

By issuing debt and levering up, MicroStrategy has effectively become a leveraged bitcoin holding company, with the value of the bitcoin it owns now dwarfing the value of the operating business. The cash flows from the opco service the debt, and when the debt matures it can be rolled (likely), or if the company wishes they can pay back the principal by selling some of their massively appreciated bitcoin stack (unlikely). To date, they have never reported selling a single bitcoin after acquiring it.

MSTR shares from time to time trade at a premium to the underlying bitcoin holdings (typically during a bitcoin bull market), or a discount (typically during a bitcoin bear market), as MSTR should outperform the price performance of bitcoin when it goes up and underperform when it goes down because of the leverage in the model.

This gives MicroStrategy another “currency” they can sell to buy bitcoin with: their stock.

When MSTR stock is trading at a premium to the underlying bitcoin, the company can issue shares to the market and use the proceeds to buy more bitcoin in an accretive fashion, meaning even though they’re issuing more shares, their bitcoin/share goes up.

MicroStrategy has been executing this share issuance playbook in tandem with the debt issuance, nearing doubling total diluted shares outstanding from 9.6 million in 2020 to 18.4 million today.

Typically there would be a limit to this, as continuing to issue stock would eventually collapse the premium and the shares would trade down to the value of the underlying bitcoin. And I’m not contending that wouldn’t/won’t ultimately happen at MSTR as well. But there’s a long ways between here and the potential end game, and as we’ll dive into later, we might soon find ourselves in a market where there is a willing buyer of MSTR stock at any price.

The situation unfolding at MicroStrategy is unique because no company has ever used their stock as currency to execute a speculative attack before.

Typically when a company issues stock it’s to fund business activities such as M&A, not to go buy a scarce, finite monetary asset such as bitcoin. Likewise, no company has ever transformed themselves into a bitcoin holding company, with the vast majority of the value of their shares attributed to the bitcoin they hold. And finally, no other bitcoin investment vehicle — ETFs, for example — has an operating company with cash flows attached to it and access to the capital markets where they can issue debt and/or equity at attractive prices to continue growing their bitcoin holdings in an accretive fashion.

Beyond speculating about the future, the empirical evidence is that MicroStrategy has been issuing more and more stock for 3.5 years now, and yet as I write this the stock trades at a whopping 66% premium to the bitcoin it holds.

Thinking that in theory “the premium must collapse” is intellectually enticing, but in practice it has not, because of the leverage the stock should actually trade at a premium in a bull market, and as we saw with GameStop, the market can wreck everyone who thinks what goes up must come down before it actually does.

As of February 15, 20% of MSTR shares were sold short betting on this premium collapsing, likely as a leg in a long bitcoin/short MSTR trade.

The stock is up 54% since then, while bitcoin is up 20% over the same time period.

Step 2: MSTR Gets Included in the S&P 500

The composition of the S&P 500 is decided by an index committee, subject to certain rules such as size and profitability requirements.

The recent surge in MSTR to a new all-time high market cap of $18.2 billion has fueled speculation that the stock will inevitably soon be included in the S&P 500, and I tend to agree.

The stock was profitable by GAAP net income in its most recent quarter and over the sum of the last four quarters, meeting profitability requirements so long as it remains GAAP profitable over the coming quarters.

At $18.2 billion, it is now larger by market cap than the smallest constituents in the S&P 500. I rate the odds of S&P 500 index inclusion by the end of the year at more likely than not.

If and when MSTR does make its way into the S&P 500, that means the aforementioned 50%+ of the market that is now passively managed will be forced, per their mandates, to buy the stock at any price.

And here is where I think it can get weird in a hurry.

Step 3: Engage Positive Feedback Loop

The following is a hypothesis about a theoretical future feedback loop and does not constitute an endorsement or recommendation to participate in said feedback loop, to buy or sell bitcoin, to buy or sell MSTR stock, or to do anything else. Caveat emptor.

Imagine, for a minute, that we’re still in a bitcoin bull market if and when index inclusion happens, and MSTR shares are still trading at a premium to their underlying bitcoin.

And say MSTR decides to issue shares to buy more bitcoin with, as they have been doing consistently for the past 3.5 years.

Doing so would result in an index upweighting, and all of the managed equity assets passively tracking the S&P 500 would have to buy the newly issued shares pro-rata to fulfill their mandate of tracking the index.

Since ~half the market are these price insensitive passive index buyers, half of the new shares MSTR issues already have a forced buyer, no matter how large of a premium to the underlying bitcoin they’re issued at.

This means for every, say, $2 billion of equity MSTR sells, they only need to find real, price sensitive buyers for $1 billion of it. They already have buyers for the other $1 billion.

But they still get to turn around and buy $2 billion worth of bitcoin.

Since bitcoin is a scarce, finite asset, the price goes up, say, 50% when MSTR buys $2 billion more.

Since MSTR is a leveraged bitcoin vehicle, when the price of bitcoin goes up, the price of MSTR stock goes up even more, say 100%.

(If you think this is fanciful, consider that in the past month the price of bitcoin has gone up by 44%, and MSTR stock has gone up by 118%.)

Since MSTR is still trading at a (larger) premium, they issue more stock to buy more bitcoin with and increase their bitcoin per share.

But this time, since the share price has doubled, for the same amount of shares they are raising $4 billion, and the index funds need to buy $2 billion.

But they don’t have $2 billion, so they need to sell off a little slice of the other 499 stocks in the S&P 500 to raise the $2 billion for buying MSTR, which slightly pushes down the price of the other 499.

MSTR buys $4 billion more BTC, pushing the price up even more. They are literally just mining fiat to buy bitcoin.

Again, there is nothing new about this, they’ve been doing it openly for 3.5 years.

At this point, the parabolic move in bitcoin and MSTR has entered the zeitgeist and the GameStop crew realizes that 20% of the shares outstanding of MSTR are still sold short. They recognize the opportunity to force another short squeeze

They realize everything they hoped to accomplish with GME is now being served to them on a silver platter with MSTR, but the setup is even better.

Since MSTR is backed by a finite, scarce asset in bitcoin, they can’t simply dilute forever. At some point there will be no more bitcoin to buy. But until that point is reached, they can dilute as much as they want, because a full half of the market is forced to buy their shares at any price.

They pile into the trade, and the price of MSTR squeezes higher as all the remaining shorts are forced to cover. Because of the short squeeze, the stock reaches a record premium to the underlying bitcoin.

The year is 2025. Between the bitcoin price soaring, driven in part by MSTR buying large quantities of it, and MSTR trading at a record premium to their bitcoin stack, the market cap has become … quite large.

After a few iterations of the above described positive feedback loop, bitcoin is worth $1 million per BTC (a price target that has been proposed by serious thinkers, operators and investors Balaji Srinivasan and Arthur Hayes). With a $21 trillion market cap, bitcoin is now valued at just a little more than gold, which has also performed quite well over the past year as global central banks have had to inject more liquidity to recapitalize the banking system and deal with a budding credit crisis in office real estate.

MSTR has again doubled their shares outstanding (as they did from 2021-2024) from 18.4 million to 36.8 million, and they’ve managed to increase their BTC/share almost 50% from 0.0105 to 0.015.

At $1 million/BTC * 0.015 BTC/share, the per share bitcoin value of a share of MSTR stock is $15,000, but it still trades at the same 67% premium it traded at on March 1, 2024 and is at $25,000 per share (split-adjusted). The company’s market cap is $920 billion, making it a part of the newly christened Mag 8.

MSTR issues more shares, 2 million this time. It’s a gargantuan $50 billion equity raise, the largest ever, surpassing the previous record of $20 billion set just 3 months ago by MSTR.

$25 billion is a large chunk of change the indexers have to come up with, so they need to again sell the other 499 stocks. This time the sale isn’t quite so small, and it pushes the prices of the other 499 down quite a bit.

Microsoft, the largest stock in the world, was trading at 40x earnings when MSTR was added to the S&P 500. But now that half the market is being forced to sell Microsoft to buy MicroStrategy (effectively, to buy bitcoin), the P/E multiple has compressed to 25x.

The stock is still the largest in the world with a $2 trillion market cap, but the stock price is down by 33% from its peak in 2024 due to multiple compression, even though AI applications have enabled it to grow revenues and profits in line with expectations.

The feedback loop continues for a couple more iterations, until MSTR is the largest company in the world by market cap.

The S&P 500 has been transformed into a savings account, like it always was, except now people are saving in money (bitcoin) instead of stocks, like they always should have been.

Normal people with day jobs who do not care to read a 10-K or take risk with their hard earned savings — call them “savers” — just stay invested in their “S&P 500 index fund,” which is now predominantly just bitcoin held by MicroStrategy.

Since it is just bitcoin anyways, all the money that was “invested” (saved) in S&P 500 index funds just moves to bitcoin and the raison d’etre for the huge asset managers whose primary function was simply managing everyone’s retirement savings accounts in the S&P 500 either go away or are right-sized for the new market paradigm.

People who want to be investors, who like reading 10-Ks and seek to take risk and earn a return on their capital, are the only ones who will part with their bitcoin to invest in risky stocks. For everyone else, bitcoin works just fine as savings and protects their purchasing power over time, there is no need to take risk.

The investors price securities a little more discerningly. After all, since there are only 21 million bitcoin, the bar for parting with and risking your capital has been raised.

Market-wide equity multiples have thus collapsed from 25-30x to 5-10x.

Conclusion

Obviously, none of this is likely to play out in precisely the way I’ve imagined above.

Please, understand that MSTR is currently trading at a 66% premium to its underlying bitcoin, and an even steeper premium if you factor debt into the per share Net Asset Value (NAV).

It absolutely can and most likely will draw down 20%, 30%, 50% or more from time to time. Don’t get wrecked.

Also, owning MSTR is not the same as owning bitcoin. MicroStrategy never has to distribute their bitcoin to their shareholders. If you want self-sovereignty and to be able to, you know, use your bitcoin in the economy, you have to own the real deal and either self-custody or collaborative-custody it.

Owning MSTR is just leveraging bitcoin to mine more fiat — a perfectly valid thing to want to do, but just be aware of what it is and what it isn’t.

That all said, I would not be surprised if some version of the positive feedback loop between bitcoin and the equity market plays out during this cycle.

Is this good? Like, for society? I’m not 100% sure (of anything), though I think yes. If systems are broken, I think it’s probably good in the long-run to fix them sooner rather than later, even if the transition is painful for many or most. The new system — in this case, a bitcoin standard — I believe promises to be better for everyone, and especially those furthest away from the fiat spigot. What’s good for the goose is good for the gander.

Alas, when allocating capital and attempting to predict the future, what you think is good is a secondary concern anyways. We must play the game as it is, not as we wish it were.

And as far as I can tell, the path to a MSTR god candle has been illuminated and the market will realize where this is eventually going at some point:

Even Michael Green, a notable bitcoin skeptic whose work I nonetheless admire, acknowledges that once MSTR is in the S&P 500, Saylor will “be able to issue secondaries to his heart’s content.”

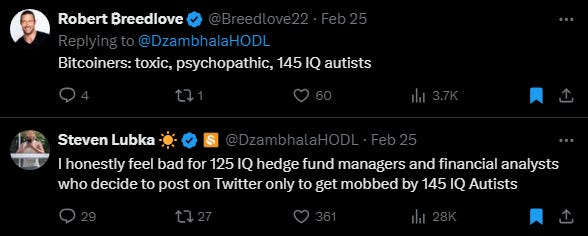

With the self-styled “autists” cross-pollinating with the bitcoin maxis, and bull market vibes back in full swing, I think it is only a matter of time until the r/wallstreetbets crowd sets their sites on liquidating MSTR shorts:

In a year where we’re set to be fed Trump vs. Biden Round 2, I won’t be surprised if people vote with their wallet, opt out, and choose bitcoin as the tool by which they express their discontent, because it’s the best tool for the job:

This is where Preston Pysh is coming from when he says MSFT, a (now) $415 stock with $10 per share in annual earnings, is worth $20 to him:

Rewiring the fiat mindset takes time.

But forcing the fiat mindset to be rewired through rewiring the markets can happen much faster.

Have you ever asked yourself — why is it, exactly, that everyone “needs” to be an investor? Why do we all learn from a young age that we must risk our savings just to keep up?

What if I want to be an artist, or a farmer, or a chef, or a software engineer, or a software salesperson, or a carpenter, or a pilot, or a nurse, or a firefighter, or a caretaker?

What if I don’t have the time nor the interest to be an investor?

When you contribute money to your 401k every month, what are you really doing? Are you saving? Or are you investing?

I would contend most people are saving. They have no interest in risking what they’ve already earned, but if they don’t, they are certain to lose it to inflation and debasement.

If people are saving their wealth in the S&P 500 instead of money, that means the equity market has attained a monetary premium.

So when you consider the S&P 500 is really just a savings vehicle for now half of the market, is it so crazy to think that half of the multiple on the equity market is actually just monetary premium? And that if we now have new, better savings technology in bitcoin, that bitcoin would assume that monetary premium, and eat half the equity market?

This is what Allen Farrington means when he says many investment vehicles have no business, at the very least, having the monetary premium that they now have, and in a lot of cases have no business even existing (50:00 - 51:07):

MicroStrategy might just be the straw through which bitcoin drinks the S&P 500’s milkshake.

And what happens when the bid gets bigger? What happens when 5 million pissed off Occupy Wall Street, GameStop, Wall Street Bets combine with the 2 million people that are still walking around with Ron Paul signs … What happens when all those people join together and join the bitcoin network?

— Quoth The Raven, What Bitcoin Did, February 16th, 2024

(Disclosure: long bitcoin and MSTR)

MSTR's holdings currently amount to 279,420 BTC obtained at an average price of $42,692, totaling an aggregate cost base of $11.9 billion. As of close today, November 11th, MSTR's market cap is just shy of $70 billion. Genius play by Saylor. The short sellers are going to be hurting.

Any thoughts Zack on Kerrisdale Capital's report yesterday on MSTR (https://www.kerrisdalecap.com/wp-content/uploads/2024/03/MicroStrategy-MSTR.pdf)?