As touchy of subjects as national defense and war are, one must grapple with them when considering an investment in PLTR 0.00%↑ . I won’t get into too much of that in this post, other than to say I believe my values and views are substantially aligned with the company’s.

In viewing Palantir purely through an investment lens, sometimes it's best not to overthink it:

Palantir's largest customer is the largest customer in the world, with the deepest pockets and highest propensity to spend: the U.S. government. You want to be selling to the U.S. Government.

There is currently a land war in Europe, and tensions are rising in the pacific theater. Palantir sells mission critical software to western and western-allied governments and militaries and is well positioned from a business standpoint for the current geopolitical environment.

Even in “peacetime” or times bereft of kinetic war, in the 21st century war and national defense increasingly rely on economic, cyber and informational capabilities relative to weaponry. State of the art encryption, security, big data, software and AI solutions are required to have an advantage. Palantir is the world class provider of these solutions, bringing government-grade security to industry, and industry-grade know-how to government.

Take the competitive and economic advantages enjoyed by government IT, engineering and consulting contractor Booz Allen Hamilton BAH 0.00%↑ and lay a SaaS business model (and actually differentiated software) on top of it and you have Palantir, on sale in today’s market for 7x 2026 consensus estimated FCF.

I believe there is material upside to consensus estimates given the fraught geopolitical era we seem to be entering and, subsequently, Palantir’s growth prospects.

Background

Palantir is the global leader in AI software sales and has monopoly-like software market share with western governments.

Palantir began as a company in 2003 providing a software platform for government use, and has since expanded into the commercial market. The company has built two principal software platforms: Gotham and Foundry.

In the company's own words (from the S-1):

Gotham was constructed for analysts at government defense and intelligence agencies. It enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, and helps U.S. and allied military personnel find what they are looking for.

The challenges faced by commercial institutions when it came to working with data were fundamentally similar. Companies routinely struggle to manage let alone make sense of the data involved in large projects. Foundry was built for them. The platform transforms the ways in which organizations interact with information by creating a central operating system for their data.

Customers pay Palantir to use their software platforms, and pricing is one-off and based on the value the company estimates their software platforms will produce for their customers.

With ~$2 billion in 2022 revenue, the company has a long runway for growth competing in a combined $119 billion and growing TAM for commercial (~$56 billion) and government (~$63 billion) software.

Moat

Most software companies are either uninterested in producing or unable to produce products that address the fundamental needs of a large institution. The investment required is too high. The potential payoff is too uncertain.

- Alex Karp, Palantir CEO, 2022 Annual Letter

While most software companies build and market one size fits all products which lend themselves to commodification, Palantir sometimes works with customers for months developing custom solutions with hundreds of components to demonstrate real value before generating any revenue, engendering customer loyalty and long-term lock-in.

Business Performance and Unit Economics

Currently, Palantir is growing both through expanding down market in the commercial sector as well as increasing Average Revenue Per Customer (ARPC) in the government sector.

In 2021, Palantir tripled its number of commercial customers from 49 to 147 while government customers remained flat at 90.

Correspondingly, ARPC in the commercial sector fell from ~$10 million to ~$4 million, while in the government sector ARPC increased from ~$7 million to ~$10 million.

After heightened, one-time costs attributable to stock-based compensation in connection with the company's Q4 2020 direct listing, sales & marketing expense fell 10% from 2020 to 2021 even as revenue grew 41%.

With a blended total ARPC of $6.51 million, CAC (2021 S&M expense / customer net adds) of $6.21 million and net dollar retention of 132%, Palantir boasts outstanding unit economics.

In fact, I calculate the NPV of the current customer cohort to be ~$8.2 billion, justifying 70% of the company’s ~$11.8 enterprise value today if they never added another customer:

Betting on Themselves

Palantir has adopted a unique strategy of taking minority equity stakes in some of their commercial customers, aligning incentives and allowing them to succeed and grow alongside their customers not only in terms of their software business but also their invested capital.

The 2021 10-k provides the below table of investment commitments. I have read articles elsewhere that detail further equity investments the company has made and although I have not been able to confirm them in SEC filings I have no reason to doubt the veracity of the information.

An example of one such investment is EVTOL (electric vehicle take-off and landing) company Lilium, who announced a strategic partnership with Palantir just this week.

Valuation

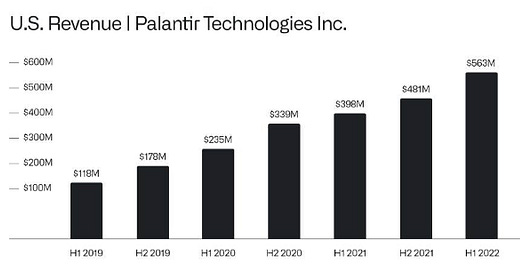

Despite the tech and growth meltdown in the equity market, Palantir's business has kept on humming in 2022. The stock price performance paints a very different picture than the business fundamentals:

After a 79% drawdown from its January 2021 highs, the stock now sits at an attractively valued 6x 2022 revenues with 80% gross margins.

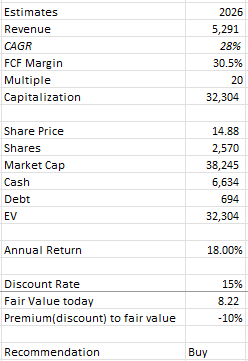

A revenue growth and margin expansion story over the next 5 years, I project an 18% compound annual return in the stock from now until 2026, based on 20x 2026 FCF estimates, 6% annual share dilution and a 15% discount rate.

Although the numbers are nice to fall back on, they are subject to change and many stocks work or don’t work over the long-run based on more intangible insights that the market is missing.

With Palantir, I outlined one key one at the top: their #1 customer is the U.S. government.

Palantir’s alignment with their customers is another.

In a world where a vast majority of the software market cap has accrued to value-extractive entities (read: advertising based business models), Palantir attacks white space and builds actually differentiated, value-creative software for their customers.

I’ll quote directly from CEO Alex Karp’s 2022 annual letter:

A misalignment exists between the producers and consumers of software.

The software industry today has become an extractive enterprise.

Most of the largest consumer internet companies in Silicon Valley have built software products whose principal value is that they enable the efficient extraction and monetization of our personal information.

We are the product for sale—not the software, which itself is often thin. Most understand and have perhaps resigned themselves to the arrangement at this point. Our inner lives are for sale.

It is also increasingly clear that the value of such software, which is essentially parasitic and constructed for the purpose of monetizing a host, can be ephemeral and fragile.

The construction of a more efficient platform for the distribution of consumer advertising was never our ambition. And we have declined to build our business on the back of monetizing data that is not ours and that we do not own.

The decision led us to focus on the nature and value of the software itself that we are building, rather than what it consumes.

The distinction is significant and is the source of our alignment with our customers. The value that our software creates in the world is a result of the software itself—not the information or data of those who use it.

And that alignment is in turn the source of everything we have built.

CEO Alex Karp is a controversial figure with strong views.

I encourage you to read the 2022 annual letter in full and the more recent Q2 2022 shareholder letter to get a sense of his values and to evaluate if they align with your own.

Personally, I appreciate the willingness to grapple with and take a stance on difficult issues. In my experience, CEOs and company’s get the customers, and shareholders, they deserve. Amazon and Jeff Bezos is the canonical example, with an uncompromising focus on investing in the business to grow long-term FCF/share.

In turn, the customers get the products they deserve, and the shareholders get the returns they deserve. Taking a long-term view is key and necessary if you’re going to own this stock.

Because the reality is that in the short to medium-term, multiple expansion and contraction is going to drive your investment results, as we’ve seen with PLTR and the whole tech/growth complex over the past 2.5 years. It’s often only once you get beyond a 5 year holding period where fundamental business performance will start to be the driver of your returns, and nothing matters more than FCF/share.

Recent Developments and Portfolio Considerations

Palantir lowered their full year 2022 guidance during their Q2 earnings call. I don’t think this is an indictment of management’s ability to forecast the business, nor do I think it’s reflective of the macro environment. I’ll explain why and why I think this highlights a feature of the business (and stock), not a bug.

Palantir's contracts, and thus revenue, are inherently lumpy and therefore difficult to forecast. I think that is the nature of the beast when dealing with governments and large annual contract values.

This is a feature because:

It means the product is more sticky/less able to be commoditized.

Dealing with governments on large, mission critical problems insulates the business from the macro environment, and you can imagine how it would even be countercyclical. For example, in 2008-2009 Palantir landed a number of contracts to help the government navigate the GFC.

It provides investors opportunities to capitalize on short-term stock price reactions if they can stay focused on the long-term story.

Point two above gets at why I think Palantir could fit nicely in many investor’s portfolios. Everyone wants to own oil stocks or Lockheed Martin when war breaks out, but long-term returns for oil stocks have been abysmal ( XLE 0.00%↑ is down 21% from it's 2008 peak, a 15 year period in which the NASDAQ has returned 450%, despite XLE outperforming QQQ by 66% over the last year) and while defense stocks have offered reasonable returns, they haven't made anyone rich like tech has.

While in the short-term, liquidity conditions will drive changes in the multiple up or down as we’re seeing today, a geopolitically tense climate is one that actually favors Palantir’s business and is conducive to them landing more sticky, long-term, large ACV government contracts will flow through to the stock price in due time.

I believe this makes Palantir the geopolitical hedge everyone wants to own paired with the SaaS business model everyone wants to own, and this dynamic will become clear over time.

Link to valuation and unit economics model.

Disclosure: I own PLTR

Disclaimer: nothing published in this newsletter is investment or financial advice. The author may be long or short any of the securities or assets discussed at any time before or after publishing.

Just came across this ~45 minute interview CEO Alex Karp did with Stan Druckenmiller just 2 weeks ago: https://www.youtube.com/watch?v=0sddHG0D0Y4

Takeaways:

-Palantir thrives in a bear market/fraught geopolitical environment because all the bullshit they compete with goes away, people (customers) get focused on survival and Palantir's products simply work and have no competition.

-Unfortunately, thinks the world is going to be a less happy place due to wars, etc. for a long time but, fortunately, for reasons that are ultimately ephemeral.

-Differentiated from a talent recruitment perspective because one of the few actually mission-driven companies. No place to work like it.